Originally established in 1972 by the British in what was then the New Hebrides, the International Financial Centre has enabled a professional and world-class modern financial industry to flourish in the soon-to-be independent Republic of Vanuatu. Over the years, successive governments have continued to support the financial centre due to its crucial role in the economic development of the nation.

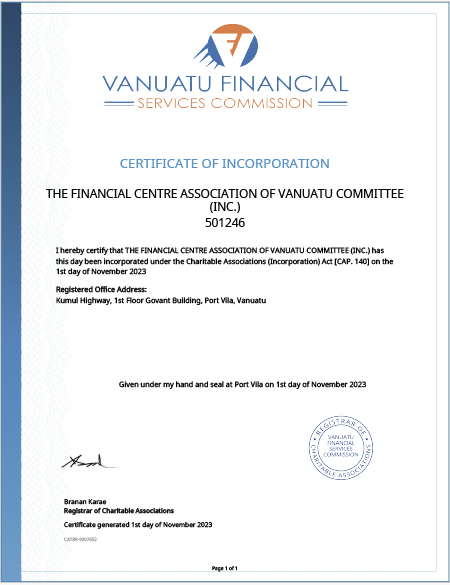

The Vanuatu Financial Centre Association (FCA) is a not-for-profit industry body established in 1993 representing banking and insurance professionals, online trading companies, brokerage firms, financial dealers, chartered accountants, business advisors, lawyers and real estate agents.

Our industry is regulated by various Vanuatu government institutions such as the Ministry of Finance and Economic Management (MFEM), the Financial Intelligence Unit (FIU), the Competent Authority (at Ministry of Finance), the Vanuatu Financial Services Commission (VFSC), the Reserve Bank of Vanuatu (RBV), the State Law Office (SLO), the Vanuatu Investment Promotion Authority (VIPA), and the Rates & Taxes, Customs and Duty, Immigration and Labour Departments. FCA members work in harmony with the various government bodies in charge of the implementation and the monitoring of Vanuatu laws that govern our industry.

The FCA is proud to have its members recognised in Vanuatu and internationally for their honesty, integrity and skills.

BRINGING DIVERSIFICATION

TO OUR NATIONAL ECONOMY

The International/Offshore business sector is really important for the health of Vanuatu’s economy, as it builds local expertise, investor trust, and public revenue. These are key drivers of development for any nation.

Offshore business makes up a significant portion of our members’ activities, from 5% to 35%, as well as those of companies which are not members of the FCA.

Every small increase in Foreign Direct Investment through our member companies has an exponential impact on our country’s economy; through supporting infrastructure and development projects, creating well-paid jobs and fostering education and advanced skills training.

EXECUTIVE OFFICERS

| Chairman | Vice Chairman | Secretary | Treasury | Member | Member | |

| 2024 | James Hudson | Francesca Grillo | Gilian Attapattu | Mathilde Augerd | Ian Kerr | Martin St-Hilaire |

| 2023 | Martin St-Hilaire | James Hudson | Gilian Attapattu | Mathilde Augerd | Thomas M. Bayer | |

| 2022 | Martin St-Hilaire | James Hudson | Gilian Attapattu | Mariana Lal | Mark Stafford | Laurie Harrison |

| 2021 | Martin St-Hilaire | Mark Stafford | Thomas M. Bayer | Damien Mullins | Flora Geodefroit | |

| 2020 | Martin St-Hilaire | Dan Agius | Thomas M. Bayer | Mark Stafford | Robert M. Bohn | |

| 2019 | Martin St-Hilaire | Robert M. Bohn | Thomas M. Bayer | Damien Mullins | Loic Bernier | |

| 2018 | Martin St-Hilaire | David Hudson | Thomas M. Bayer | Robert M. Bohn | Dan Agius | |

| 2017 | Martin St-Hilaire | David Hudson | Thomas M. Bayer | Robert M. Bohn | Dan Agius | |

| 2016 | Martin St-Hilaire | David Hudson | Thomas M. Bayer | Jean Frederic gagné | Mark Stafford | |

| 2015 | Robert M. Bohn | Gayle Stapleton | Thomas M. Bayer | Jean Frederic gagné | Maxwell McGill | |

| 2014 | Robert M. Bohn | Gayle Stapleton | Thomas M. Bayer | Martin St-Hilaire | Mark Stafford | |

| 2013 | Robert M. Bohn | David Hudson | Thomas M. Bayer | Martin St-Hilaire | Mark Stafford | |

| 2012 | Robert M. Bohn | Mark Stafford | Thomas M. Bayer | Martin St-Hilaire | Keith Hango | |

| 2011 | Mark Stafford | Robert M. Bohn | Thomas M. Bayer | Martin St-Hilaire | Keith Hango | |

| 2010 | Mark Stafford | David Hudson | Robert M. Bohn | Martin St-Hilaire | Keith Hango | |

| 2009 | Mark Stafford | David Hudson | Thomas M. Bayer | Martin St-Hilaire | Peter Biassin | |

| 2008 | Mark Stafford | Jim Batty | Thomas M. Bayer | Angelika Becker | Nigel Morisson | |

| 2007 | Jim Batty | Mark Stafford | Charles Kleiman | Phil Tremethick | Nigel Morisson | |

| 2006 | Jim Batty | David Hudson | Charles Kleiman | Michael Flower | Mark Stafford | |

| 2005 | Robert Agius | Jim Batty | Thomas M. Bayer | Bob Hughes | David Hudson | |

| 2004 | Robert Agius | Jim Batty | Thomas M. Bayer | Bob Hughes | David Hudson | |

| 2003 | Mark Stafford | Bob Hughes | Gary Blake | A Rogers | Thomas M. Bayer | |

| 2002 | Mark Stafford | David Hudson | Malcom Tilbrook | Gary Blake | Thomas M. Bayer | |

| 2001 | Robert M. Bohn | Mark Stafford | Jude Whiteman | Kevin Lindsay | David Hudson | |

| 2000 | Robert M. Bohn | Jude Whiteman | John Ridgway | Mark Stafford | Kevin Lindsay | |

| 1999 | John Ridgway | Geoffrey Gee | Judy Whiteman | Robert Bohn | Bill Hawkes |