By Peter Judge

When considering employment conditions, it is always difficult to find a single reform that will make everyone happier, as any change will generally benefit either the employer or the employees at the expense of the other. The aim therefore should be to find a package of reforms that leaves everyone happier overall.

The first idea is to entirely remove severance, which is something that many businesses really strongly dislike.

Severance doesn’t exist in most countries, and many potential investors (foreign and domestic) find it a difficult system to understand and implement. It can also be a point of confusion between employers and staff. It also means that businesses either must hold cash for long-periods (without earning any interest) or have unfunded obligations, or simply pay off severance on an annual basis.

Severance was an issue with the minimum wage increase, as some businesses suddenly saw their severance liability jump with no warning leaving them struggling to find this money.

Severance also creates a disincentive for businesses to reward long-standing staff with a pay-rise. This is because the severance payment is based on the final salary, and so any pay-rise also impacts on the historic liability.

The time after which severance can be claimed when the employee quits was recently reduced from six years to one. A number of businesses reported that staff were now quitting after 12 months to get the extra pay, leaving businesses short-staffed and individuals without jobs.

A number of businesses were also terrified about the possibility of severance increasing to two months.

Of course, this should not be at the expense of the employee. One option is for the employer’s VNPF contribution to be increased from 4% to 12% (employee’s contribution should stay at 4%). Businesses and authorities should be given two years to pay off their outstanding severance at a schedule of

their choosing.

The increased VNPF contribution could go towards two new funds. The first idea is a disaster fund, for use by individuals when authorised during or after an emergency. Allowing individuals to have access to funds when a disaster hits is beneficial for both them and the economy – but it cannot be at the expense of people’s long-term security in the form of their pensions.

The second fund idea is a savings fund, which seeks to replicate the main benefit of severance, which is that it allows workers to build up pots of money, when saving can be difficult. This could work by people only being able to access this fund once every five years.

As an alternative long-term benefit, businesses should also be mandated to give an employee an additional oneoff 20 days of paid leave when they have worked for the company for five years.

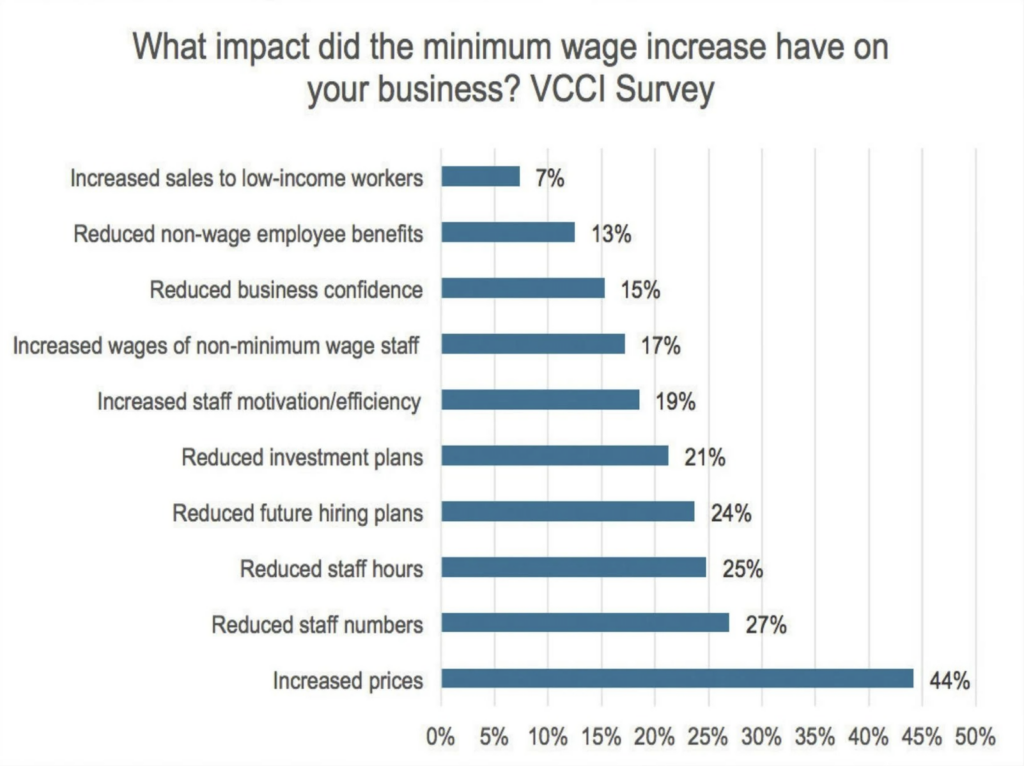

On the minimum wage, there was little push back from businesses interviewed about the level of the increase. Indeed the rate remains low given the cost of living, something that many business owners acknowledged.

That is not to say there were no impacts. Many businesses raised prices, and there were a small number who laid off some staff. Others said it would make them less willing to take an additional staff on a trial period, and there remain concerns about enforcement.

The biggest issue was how the increase was introduced. The lack of consultation or process, when combined with the backdating of the increase, had a major impact on many businesses’ confidence and for some businesses was an unplanned financial headache.

The Government should therefore introduce a clear plan for the minimum wage. This should aim to raise the minimum wage by more than inflation (as raising it in line with inflation means that the living standards of the poorest won’t increase) with clear processes and giving businesses time to plan and adjust. It must also be affordable for businesses, noting that improving employee and business productivity is the best way to achieve this.

The Government should also reconsider the suitability of the minimum wage for micro and small businesses in rural areas. The economics of these businesses and the lower cost of living means that a lower rate may be necessary, but further research is needed.

Another idea is to introduce a ‘trainee minimum wage’, maybe VUV 250, for the first month of employment. This allows businesses to train staff while they are new and often unproductive while also allowing them to find out which workers are reliable. The hope is this would encourage businesses to be more willing to give new staff a go, increasing hiring rates.

Businesses also frequently raised the number of sick days (21, well above most of the rest of the region) and public holidays (for which Vanuatu is well known).

One idea is that sick leave is reduced (for example to 12 days), and the public holidays for Ascension Day, Assumption Day, and possibly National Unity Day are removed.

This would have to be offset with a number of employee benefits. One idea is a statutory paid compassionate leave, for 5-10 days. Workers in Vanuatu have a range of family obligations and it only makes sense for the law to recognise and account for this.

It is also suggested that six new public holidays are introduced, making December 24th to January 1st one giant public holiday (possibly with a new Unity Day on December 29th). This idea goes back to what the ultimate point of the economy is –not to make as much money as possible, but to have a healthy and happy population living sustainably, and a giant Christmas public holiday would bring a lot of joy.

There is clear international evidence suggesting that when the whole of society takes a break together, it is extremely good for wellbeing. The benefits may be even larger in Vanuatu,with its community focus.

This idea also formalises what is already basically a reality for many. Most of Government and much of the private sector already choose to shut down during this period.

It is strongly in the interest of businesses to have well-rested and happy workforces and bosses, which this idea encourages. It also makes planning easy for businesses, many of who will simply choose to close for the break (a good outcome) while being able to operate more easily for the rest of the year.

Furthermore, those people working this period are generally either be working in essential services, or for businesses which are very busy. These workers are often towards the bottom of the pay spectrum – they deserve higher pay to work over Christmas.

Over the long run, the aim must be for people to be able to have a higher standard of living while working fewer hours. This is the way much of the world is going and is an obviously beneficial outcome for society if achievable. For this to happen, there must be drastic improvements in productivity. This is a complex issue, involving a wide range of factors such as housing, public transport, technology, worker ethic, quality of investor, and most importantly education and training.

This is part of a series of articles by Peter Judge, Director of Economics and Research at Pacific Consulting Limited and author of the recent VCCI Private Sector Economic Outlook. The purpose of the series is to spark debate and further ideas, noting much more work is needed. All views expressed are solely his own.