From Blackbirding to Blacklisting: the EU’s ongoing subjugation of Vanuatu

Imagine you gained independence only 40 years ago from France and the UK, you are the world’s most vulnerable country to natural disasters, you are ranked as the 30th poorest globally (right after Haiti), you are one of the world’s smallest physically (83 islands are collectively slightly larger than Jamaica) and population-wise (slightly more populous than Barbados), you only graduated from Least Developed Country Status in December 2020 (in a pandemic, months after category 5 cyclone Harold hit), you are classified as a Small Island Developing State, and you are struggling to survive, let alone overcome the deep, structural, institutional and socio-economic weaknesses inherent in extractive colonies.

Now, imagine that your former colonizers see it fit to place you on not one, but TWO Blacklists, for alleged tax and AML/CFT non-compliance with their rules, despite being cleared by the globally recognized tax and AML/CFT authorities. This, when only an estimated USD7 million in corporate tax revenue is ‘lost’ annually due to your zero-corporate tax, while an estimated EUR6 trillion is managed in never-Blacklisted Luxembourg, for example. How could this ever be justifiable?

Furthermore, it is quite the bureaucratic and statistical feat that the European Union (EU) concocted and executed a methodology for their Blacklists, so complex, so sophisticated, so precise, and ultimately so effective in achieving their true intent, that it produced not one, but TWO Blacklists, where NOT ONE SINGLE COUNTRY is predominantly white. It is embarrassing that even EU Members of Parliament highlighted the fact that jurisdictions currently on the EU tax haven Blacklist account for less than 2% of worldwide tax revenue losses, and that EU “member states forgot something when composing it: actual tax havens.” The EU’s Blacklists are farcical at best, and devoid of any shred of credibility or validity.

The EU forgot something when composing its Tax haven Blacklist : actual tax havens

The EU’s actions are extrajudicial in nature, given that the FATF and the OECD are THE internationally recognized authorities on AML/CFT and Tax policy respectively — NOT the EU. The extent of the EU’s overreach into Vanuatu’s sovereignty and the OECD’s and FATF’s territory, its grossly disproportionate treatment of one of the world’s smallest, poorest, and most vulnerable countries on earth, its shamefully discriminatory stance based on size and ethnicity, and ultimately, its unapologetic immorality and de facto subjugation of the people of Vanuatu, is beyond abhorrent.

The EU’s Blacklists represent indisputable examples of entrenched institutional racism and bullying. The penalties being imposed on Vanuatu have the potential to damage its economy irreparably. This is nothing short of economic warfare. Especially in the context of the pandemic, the EU’s behaviour is totally unjustifiable. The EU’s Blacklists are a clear manifestation of Europeans’ longstanding penchant for domination, exploitation, and brutality, which evidently continues unabated even today. In the context of a global pandemic in the first place, and #BlackLivesMatter – when it is finally politically incorrect to continue to behave in such a brutal, neo-colonial manner – we demand that the EU cease and desist from its economic warfare, dressed up as its totally unjustifiable Blacklisting of Vanuatu.

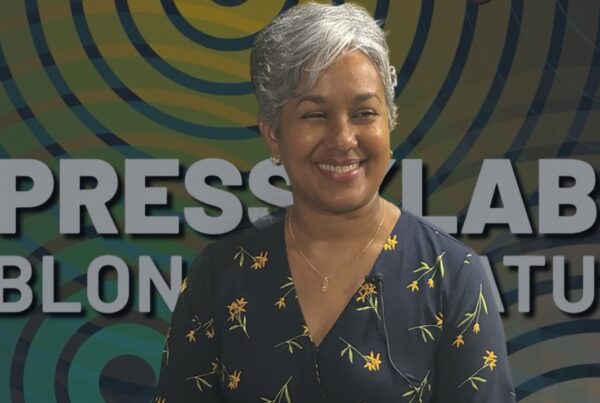

About the author

Recognized as a top economist and advisor on the Caribbean, Marla Dukharan has led discussions and published reports on the implications of EU Blacklisting, COVID-19, BREXIT, and changing US and Chinese policies, among other geopolitical developments. Marla has become a highly sought-after keynote speaker internationally on policies that foster gender equality, reduce income inequality, and promote new models of fiscal and economic resilience to create more a prosperous and sustainable socio-economic future. Marla is passionate about resolving the causes of slow economic growth and works openly to bring important issues to the forefront of public awareness, enabling the transition from attention to action on topics that directly hinder sustainable progress.