Executive Summary

Financial Inclusion or Inclusive Financing is an initiative to deliver financial services such as deposits and savings accounts, credit, payment channels and insurance services, affordable and accessible to the disadvantaged, low income earners, the underserved or unserved segments of the society. Financial Inclusion is now widely accepted as an effective strategy for equitable economic growth, through which low income earners can be economically empowered and can improve their standard of living.

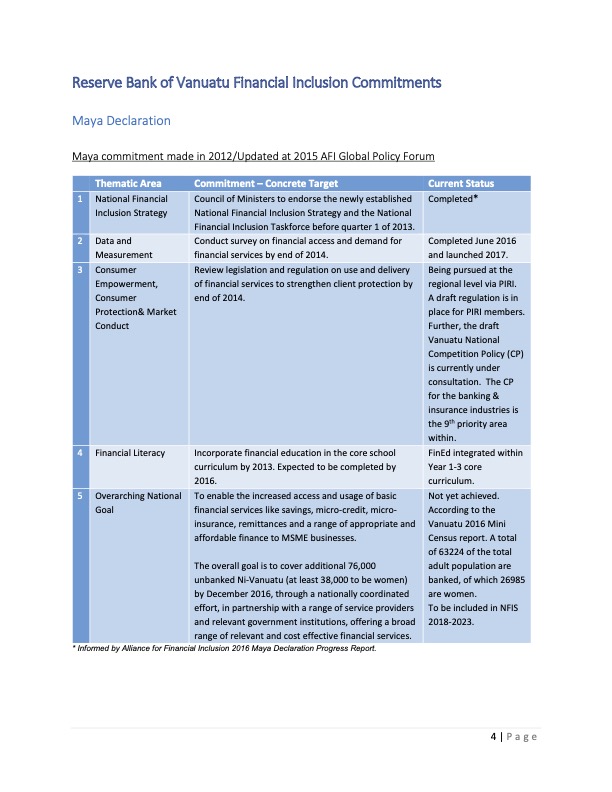

Financial Inclusion has become an important policy and development agenda for many developing countries including Vanuatu. Vanuatu is amongst the many developing and emerging countries globally that have made measurable commitments under the AFI’s Maya Declaration to achieve financial inclusion.

The Vanuatu National Financial Inclusion Strategy (NFIS) 2018 – 2023 presents the medium-term road map to drive financial inclusion across the country. This five year strategic plan is linked to Pillar 3 of the Vanuatu Government’s National Sustainable Development Plan 2016-2030. Pillar 3 seeks to ensure a stable economy through sustainable and equitable growth and has nine main objectives, the latter two being “ECO. 1.8 – Ensure financial sector stability and make financial services affordable and accessible for all through pursuing financial inclusion strategies. ECO 1.9 Promote financial literacy and consumer empowerment.”

In addition, the NFIS is further informed by the work of the Pacific Islands Regional Initiative (PIRI) in the region, together with the recently launched Vanuatu Financial Services Demand Side Survey on Financial Inclusion.

The NFIS has been developed after a series of consultations with key financial inclusion stakeholders across the private and public sectors and includes a series of structured consultations with civil society, non-governmental organisations and development partners. These consultations have been jointly facilitated by the Reserve Bank of Vanuatu and the Pacific Financial Inclusion Programme, including consultations prior to, during and post the preparation of the NFIS.