Key Findings

There were several key themes emerging from qualitative data gathered during the interview process.

Overall, the majority of businesses interviewed reported that turnover remains considerably down. This can be attributed to less money being injected into the local economy via tourism, the fact that thousands of people have either lost their jobs or are on reduced hours/pay, and that numerous high-spending expatriates have left the country. This has been offset to some degree by higher Government spending, seemingly higher remittances from seasonal workers (although the lack of data makes this very hard to confirm), and from increased spending from high net-worth individuals who are no longer able to travel internationally.

Despite these mitigations, the overall picture is still one of heavily reduced demand.

As an example, data provided by a local accountancy firm confirms that total turnover for their 42 business clients was 40% lower in July 2021 than July 2019.

As an example from the informal sector, the 20 vatu food vendors at Port Vila’s Chief’s Nakamal have reported a fall in sales of 70% on a normal day. Many survey respondents reported demand continuing to fall – 58% said turnover was lower for June-August 2021 compared to the year before, with just 19% reporting an increase.

This slow decline in demand can also be seen in businesses plans for their workforce. 20% of survey respondents reported that they had plans to reduce their workforce size in the near future, with a further 41% being unsure.

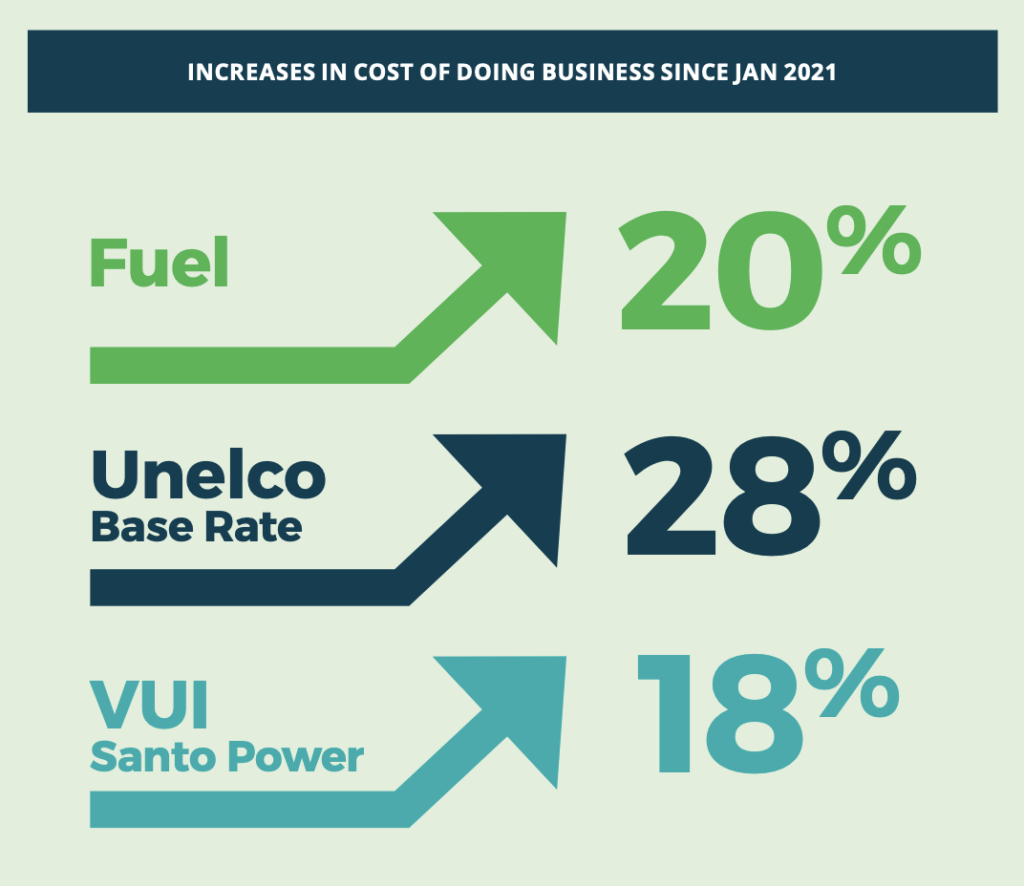

Numerous businesses interviewed reported an increase in the cost and difficulty of doing business in Vanuatu. One key factor is the increased cost in global shipping, accompanied by delays to many ships. Other factors include

an increase in the global prices of fuel (approximately 50% since January), which in turn has impacted on the price of fuel at the pump in Vanuatu which has risen approximately 20% since January, and the price of electricity – UNELCO’s base rate has increased by 28% since January and VUI has risen by 18%.

35% of survey respondents reported a substantial increase in the cost of doing business, with a further 35% reporting a slight increase.

Whilst prices are not as high as they have been in the past, these price increases have come at a time many businesses have already reported a substantial fall in demand. Businesses have a choice of either passing on the cost increases (leading to inflation and reduced demand), of absorbing the cost increase and further reducing profit margins, or of a mixture of both. There remains a high risk of imported inflation for the wider economy.

Merchandise exports have fluctuated due to a combination of lower international demand and issues associated with global shipping. Overall exports in 2020 were 11% lower than in 2019, whilst exports in Quarter 1 of 2021 were the lowest recorded (quarter) since 2010. Conversely, exports in Quarter 2 were higher than any quarter since 2017. Overall, for the first half of 2021 exports were almost exactly the same level as in the first half of 2019, although the composition has changed, for example kava exports fell 42% over these two periods, whilst copra exports were up 268%.

Those interviewed consistently reported an acute oversupply of kava, caused by a combination lower demand and increased production. This has led to reports of many farmers being unable to sell their kava. There was widespread frustration from within the industry at the slow implementation of the promised commercial export pilot into Australia of kava products.

Microbusinesses in Port Vila were unvaried in reporting sharp falls in income. This group without exception reported a fall in income of at least 50% compared to before COVID.

This group were most likely to report that they were struggling with affording basic living costs including school fees. In case of a widespread outbreak, this group reported being extremely vulnerable – for example there was widespread concern about how they would afford the most basic goods during any lockdown.

For larger, more formal businesses within Port Vila, there was more variation in their situations. Unsurprisingly, the smaller a business, or the more dependant it was to international tourism, the more likely that the business reported being at risk of not surviving this economic crisis. A significant number of businesses in this category reported remaining in a highly insecure position due to the fall in demand and increased cost of doing business. For these businesses, cash flow is tight as are profit margins. There was varying ability to cope with a lockdown, with many businesses reporting being highly There was limited scope for diversification for these businesses.

Businesses operating within municipal council zones were overall the most positive in their situation and outlook. They reported a lower reliance on earnings via agriculture and tourism than other areas, and a higher exposure to Government expenditure. With a few exceptions, these businesses generally had high confidence levels in surviving COVID, with some businesses continuing to invest. Some microbusinesses in the zones – such as transport operators – did report a large fall in income.

Within provincial/rural Vanuatu, there was a wide variation in the economic impacts of COVID-19 depending on the specific economic characteristics of each community. Those communities who were more dependent on tourism or kava sales in particular reported larger falls in income, with reports of children no longer attending school. Examples include Central Pentecost and East Tanna, whose high reliance on kava and tourism respectively has been compounded by recent disasters (TC Harold and

Mt Yasur ashfall). Conversely, communities with a larger number of men and women on seasonal work programs, and/or Government employment reported much more limited impacts.

Businesses were far more used to the situation than last year, having had another 12 months to adjust. However, business confidence in the medium-term remains low, with over 50% of survey respondents reporting low or very low confidence that they would be operating in 5 years.

The views from the private sector on the Government response to the economic crisis were mixed.

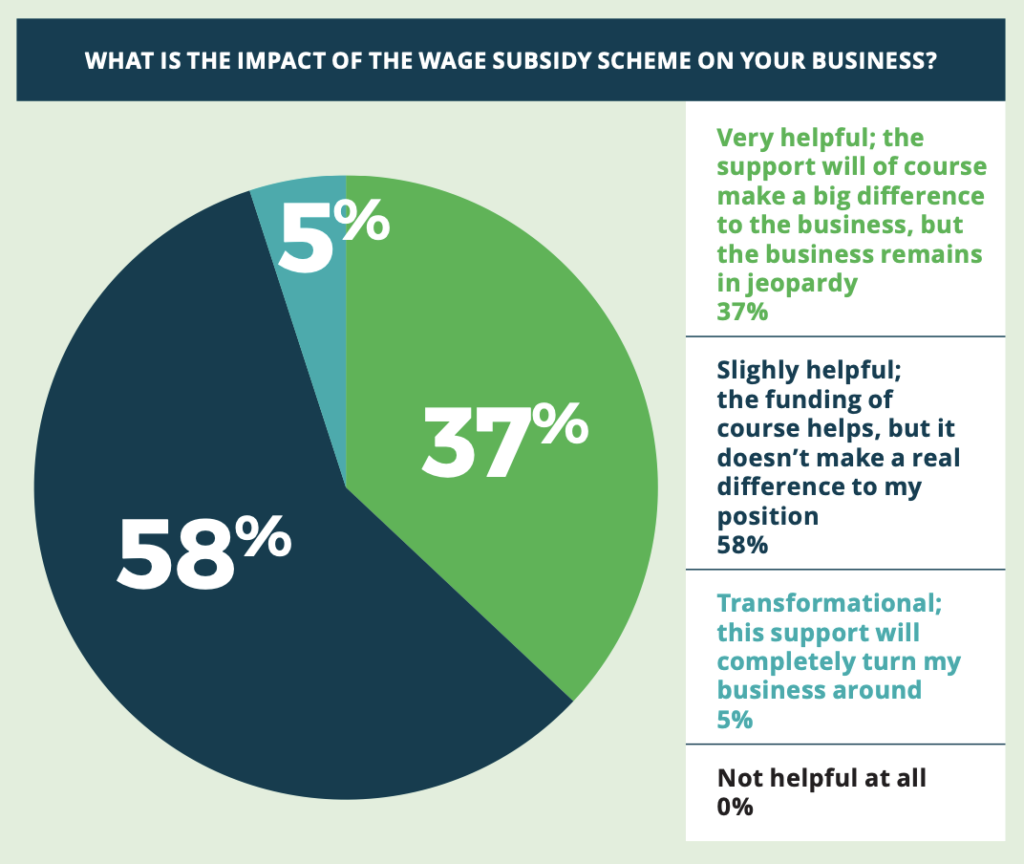

The concept of the second stimulus package was generally % well received, although the delays in its implementation in 2021 have impacted its immediate effectiveness. The Small Business Grant in particular was highlighted as being of particular benefit to micro and small businesses. The Wage Subsidy Scheme was generally seen as beneficial, in some cases transformational. Many businesses interviewed were not aware they were eligible, with a limited number choosing not to apply.

Numerous businesses interviewed reported increased Government spending as having helped to support their business over the past 12 months, although the benefits were relatively concentrated. Conversely, many businesses reported large outstanding payments from the Government, with delayed payments a key factor affecting cash flow.

There was widespread fear about what the economic impacts of a widespread COVID outbreak at low vaccination rates would mean to the economy. Only 5% of businesses surveyed stated they would continue to operate at full staff levels during an extended lockdown, with only 36% of non-tourism businesses saying that they would be able to pay their staff for more than 4 weeks in a lockdown

(23% were unsure). With many businesses reporting being in such precarious positions, it is unclear what the eventual impact would be for the economy if there is a further drop in demand and/or further disruption to supply. There were varying levels of preparation reported for a lockdown scenario.

In general essential service businesses have detailed plans in place whilst smaller non-essential businesses were far less prepared.

Many businesses reported that they were highly uncertain about surviving a prolonged border closure (defined as another 12 months from time of survey). For example, within the ‘Accommodation and restaurants’ sub-sector 59% of those surveyed had very low confidence that they would be operating if the borders are unable to open until 2023. Many businesses are depending to some degree on support from commercial banks, or on continued injections of cash from owners/investors. Each individual business has its own set of characteristics which dictates how much longer they can sustain this for.

51% of businesses in this Accommodation and Restaurants sub-sector reported using personal savings for survival.

There is an extremely high level of uncertainty within the business community, caused by a raft of internal and external factors. The lack of a clear roadmap from Government out of the current border closure scenario was a commonly reported contributor to this uncertainty. Businesses were united in their desire to see an accelerated vaccination program rolled out nationally as laying the foundation for economic recovery.

Overall, the risk level of further negative economic shocks remains exceedingly elevated. There

are a number of contributing factors to this, including but not limited to: Vanuatu’s low level of preparedness for COVID (vaccination rates, public health readiness, business preparedness), when COVID will come to Vanuatu, when borders are able to re-open to tourism (and what this looks like – for example what is the future of Air Vanuatu), when the next natural disaster occurs and what this looks like, and what is happening currently within the financial services sector (such as correspondent banking or potential EU blacklisting).