Executive Summary

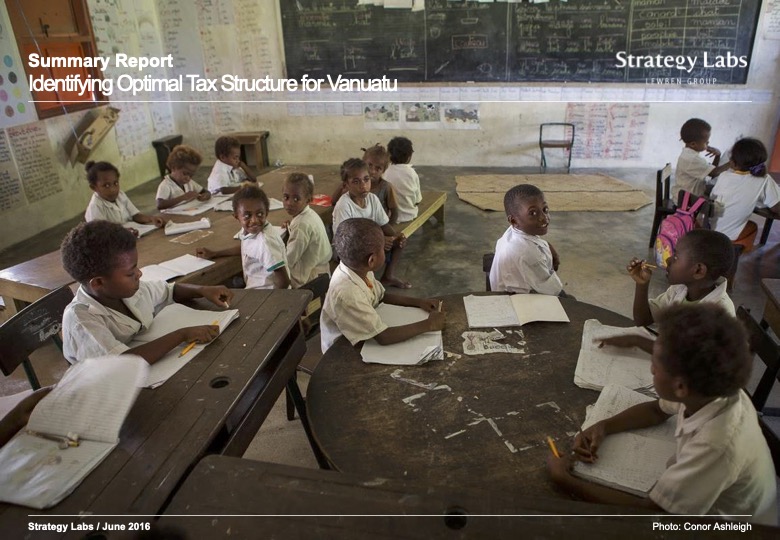

Long-term prosperity through strategy aimed at growth and education

The government of Vanuatu is facing a difficult challenge of adjusting its tax structure in a way which would help increase revenues while at the same time ensure high standards of living for its population in the long run. Human capital, i.e. education and skilled workforce are what separates the rich countries from the poor, and enhancing the level of local schools should be one of the top long-term strategic goals. To increase government revenues for funding social and infrastructure projects, the medium-term development strategy should be aimed at capturing foreign investments, creating new jobs and attracting skilled labor force from abroad.

FDI as a key instrument to sustaining long-term growth

Foreign investment brings financial resources and new businesses to Vanuatu and in such way helps create new jobs as well as generate more fees and VAT revenue for the government. This revenue can then be used to finance medium and long-term development strategy projects which in turn will generate further flows of investments and create a virtuous circle fueling economic growth.

Creating enough jobs for a rapidly growing nation

Vanuatu population numbers are growing significantly. The job market must follow, signaling the need to prioritize job creation in the medium-term. This could potentially be achieved through structuring tax incentives for industries and individual businesses which promote more employment opportunities for the local population. Developing tourism sector could prove to be the most reliable strategy as it would give a considerable boost to a wide range of local industries.

Attracting skilled labor to meet the daily needs of the population

Due to its small population size and shortage of skilled labor locally, Vanuatu relies heavily on importing talent from abroad to fill critical roles in schooling, medicine, finance, government administration and many other sectors. In the medium term, the country should actively try to maintain its competitiveness in the PICs region to attracting foreign professionals with favorable tax structure

as a primary instrument for doing so.

Introduction of income taxes would be counter-productive

Major changes to current tax structure, e.g. introduction of personal income and corporate taxes are not recommended as they would significantly hinder the country’s potential to achieve identified medium-term strategic priorities of bringing in FDI, promoting local business activity and job creation, and attracting foreign talent. It is very doubtful that the newly acquired tax revenue would outweigh the costs of collection which include huge investments in systems, training of tax inspectors and resources for increasingly complex tax administration. Wasting valuable human resources on such trivial tasks as tax collection is also questionable in a country where availability of competent labor is so limited.

Increasing public revenue through compliance and tax rate adjustments

Targeting higher tax compliance and adjusting rates of current taxes could be a much more effective and quicker way of raising revenue for the government, at the same time contributing to implementing medium-term strategic objectives. VAT is currently the largest source of public income. Naturally, the largest potential lies within increasing VAT collections and adjusting VAT rate to 15%. Higher excise rates, particularly for tobacco products, as well as higher land and license fees is another potential source to raise revenues. Finally, considerable government financing opportunities could be unlocked by gradual sell-off of its land and buildings assets which would also help boost local entrepreneurship and reduce administrative strain. All these measures combined could provide government funding necessary to finance long-term strategy aimed at ensuring sustainable economic growth and prosperity.