By Marla Dukharan

“Still less, let it be proposed that our properties within our own territories shall be taxed or regulated by any power on earth but our own. The God who gave us life gave us liberty at the same time”

– Thomas Jefferson, “A Summary View of the Rights of British America” (1774)

Thomas Jefferson’s vision for a USA in gestation came at a time when roughly 2.5 million persons inhabited the 13 colonies. By today’s1 definition, the USA was then a ‘small’ state – even smaller than Jamaica is today. And while countless variables created today’s USA, its foundational underpinning, the very raison d’être of that nation, is freedom.

What an undertaking for this small, remote, and fragmented state to so audaciously establish its sovereignty. The founders of the USA refused to define themselves only as victims of religious persecution and economic subjugation. Instead, they chose a more positive and constructive narrative and adopted a more risky but ultimately more rewarding path.

But that was an 18th-century privilege. The same God who gave contemporary small states life, evidently did not bless all of us with the same liberties and sovereignty, however. Just ask Vanuatu. Small states’ 21st-century reality is one of captured and biased omnipotent ‘global’ institutions, which powerful nations construct and weaponise to serve their needs by applying their rules and sanctions unilaterally, disproportionately, and conveniently.

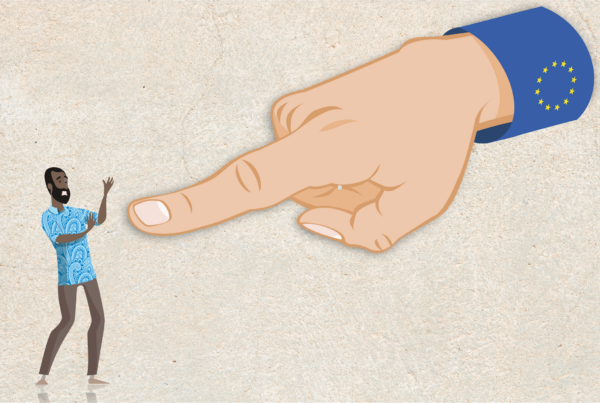

For example, there are widely acknowledged breaches of the UN Charter2, for which sanctions are yet to be imposed, and no apologies have been forthcoming. Illegally undertaking a bloody invasion of an Islamic oil-rich state, purportedly to address human rights abuses and the manufacture of weapons of mass destruction, is juicy headline fodder. Images of murdered civilians and destroyed ancient cities stir emotions and elicit strong reactions. But when the European Union (EU) unjustifiably blacklists economically insignificant Vanuatu for ‘non-compliance’ with rules they never agreed to and have no (legal or otherwise) obligation or even ability to comply with, there are no headlines. Nobody notices. Nobody understands. And nobody cares.

When Vanuatu3 – the world’s 30th poorest nation and the one most vulnerable to natural disasters, hit by two cyclones in 2015 and 2020, and a French colony until 40 years ago – is blacklisted TWICE by the EU, nobody says a word, especially not France4. The EU’s shameless and indefensible double blacklisting of Vanuatu offers a glimpse into the real risk that the Global Minimum Tax deal (this deal) could open yet another door to discrimination and act as yet another vector for vulnerability of weaker states. Those tempted to dismiss this as mere sensational conjecture, should read further.

The untold damage already inflicted by the EU’s blacklisting5 on vulnerable societies is ignored, while the EU’s own guilty member-states and allies are spared6. It is quite the bureaucratic and statistical feat that the EU was able to concoct and execute a methodology for its blacklists, so complex, so sophisticated, so precise, and ultimately so effective in achieving their true (unstated but obvious) intent, that it produced not one, but TWO blacklists, where not one single country is a (non-compliant) EU member state or ally, and not one single country is predominantly white. Is this an institution we can trust to be just?

The countries7 pushing this deal are responsible for two-thirds of the world’s corporate tax abuse, according to the Tax Justice Network8 (TJN). Let’s start there. This and several other cracks are already widening, threatening the credibility and implementation of this deal:

- The OECD itself9 found that corporate tax is the most harmful for growth with research stating “Countries with a lower corporate income tax are likely to grow faster and attract more investment and jobs than high-tax countries.” What manner of institution goes through the trouble of conducting empirical research, just to ignore it? Janet Yellen’s self-congratulatory prediction10 that “We’ve turned tireless negotiations into decades of increased prosperity” begs the question – prosperity for whom? Perhaps she hasn’t read the OECD paper.

- Not only are OECD members responsible for over two-thirds of the world’s corporate tax abuse, but the OECD itself “failed to detect and prevent corporate tax abuse enabled by the OECD’s own member countries – and in some cases, pushed countries to rollback their tax transparency,” according to TJN11. Can this institution be trusted to police this tax effectively and equitably?

- The fact that four countries (out of the 140 involved in the negotiation) continue to hold out – Nigeria, Sri Lanka, Pakistan and Kenya – is telling. What else do these four nations have in common? Well, they are all lower middle-income countries, they are all signatories to China’s Belt and Road initiative, and their total “Share of global tax havenry,” according to TJN, is 0.14 per cent (attributable solely to Kenya – the rest are nil). Perhaps these countries have decided to preserve their tax sovereignty and legal recourse options, recognising that they are, in fact, not the problem.

- As obtained with the US-UK illegal invasion of Iraq, noble ideals are being shamelessly touted for motivating this deal. The New York Times12 reported the French Finance Minister as stating “The level of inequality around the world was totally unacceptable, and the best way of reducing the inequalities in a very short lapse of time was to use the taxation tool.” Are the French experts in resolving inequality? The OECD’s Chief Economist found13 that “The recent yellow-vest demonstrations…are also rooted in a profound inequality…It takes more than six generations in France for a person at the bottom end of income distribution to reach the mean. Of all the OECD countries, only Hungary shows more social determinism than France.” On this pseudo-égalité, Thomas Pikkety commented “this great national myth of France as egalitarian and an exception to the rule is grossly exaggerated and…is too often used by the dominant groups to justify our own national hypocrisy.”14 Make no mistake – there is nothing noble motivating this deal. Governments want more fiscal revenue. Simple.

- This deal is expected to gross some US$150 billion annually, but how exactly could this help to resolve inequality on a global scale? How much will be earmarked to support the most vulnerable and address the rising socio-economic inequalities among countries? How much will be devoted to natural disaster recovery and building climate adaptation in small states in particular, whose very existence is threatened by the climate change and sea level rise directly caused by the biggest greenhouse gas emitters15 in the OECD?

- According to US President Biden16, this deal is about competition; “This race to the bottom hasn’t just harmed American workers, it’s put many of our allies at a competitive disadvantage as well”. And while fair competition on a level playing field is exactly what the global economy needs, as demonstrated earlier, powerful countries and their institutions are not known for their fairness, and weaker countries are consistently held to a higher standard. On unfair competition and dispute resolution, the number one complainant AND defendant at the WTO is the USA17, but developing countries are notoriously disengaged from the dispute settlement system because it is rigged against them. Why would this deal be any different?

- Will OECD nations’ effective tax rates match the nominal minimum 15 per cent, or will their incentives and concessions lower the tax burden to improve their competitiveness? Oxfam suggests the latter18: “Calling this deal ‘historic’ is hypocritical and does not hold up to even the most minor scrutiny…including a complex web of exemptions that could let big offenders like Amazon off the hook.” Again, can the OECD be trusted to police this deal effectively and equitably?

- 136 participating countries are required to implement the tax by 2023 but a 10-year “grace period” has been included. Perhaps this also allows for the ‘unintended’ consequences19 and the considerations of the disaffected to be addressed. But is this sufficient time for the participating countries to prepare their tax administration systems? The Swiss Finance Ministry recognises this timeframe as unrealistic even for them and has demanded “that the interests of small economies be taken into account”.20

- TJN21 criticised this deal for its inequity and exclusivity, stating “it will neither curb profit shifting effectively, nor provide substantial revenues to more than a handful of OECD member countries. Everyone else has been left out – especially lower-income countries”. Indeed, lower-income countries were largely excluded from the so-called ‘inclusive framework’ for negotiations, though some ‘improvement’ has been acknowledged; “We’re on the table, whether as a diner or the dinner, eating in equal ration with other members of the inclusive framework, is still left to be seen.”22

Alas, there is no reason to believe that the OECD, which is already deficient in policing existing tax standards, can produce a better outcome with this deal. But what if proper policing and fairness was never the intent? The outcomes achieved would make a lot more sense in this case.

What does this deal mean for small, poor, and vulnerable nations like Vanuatu? As discussed above, there is no reason to expect that Vanuatu will be treated fairly by those behind this deal. Apart from Trinidad and Tobago, Vanuatu is the only country on earth to be double blacklisted by the EU. It appears that the French politicos are in full support of this23, so it is unlikely to change. Indeed, Vanuatu has been listed as “partially compliant” overall with the Global Forum Peer Review of the OECD since 2019 and is “no longer subject to the FATF’s monitoring process” since 2018, yet the EU is able to get away with double blacklisting Vanuatu in 2021 for supposed tax and AML/CFT ‘non-compliance’. All appeals via the diplomatic channels24 to have Vanuatu removed from the EU blacklists have failed, even on the grounds of disproportionate treatment25. The EU’s double blacklisting of Vanuatu is totally indefensible, yet they are able to perpetuate it without reproach. Why should Vanuatu expect to be treated any differently under this deal?

One of the serious but less-known challenges that is sure to arise in the compliance assessments with this deal is the (convenient) interdependence of these global institutions’ assessments and classifications of countries. Being blacklisted by the EU makes Vanuatu et al more likely to be similarly classified by others. For example, the EU’s methodology for identifying AML/CFT “High Risk Third Countries”26, created in 2015 and updated as recently as 2020, includes in its scoping criteria “International Financial Centres (IFCs) based on the IMF offshore financial centre (OFC) definition”. In 2008, the IMF produced a list of Offshore Financial Centres27, but the IMF “has not used or maintained the list of Offshore Financial Centers” since. Why would the EU continue to use this abandoned 2008 IMF list in its scoping criteria in 2020? Because it is convenient to do so! Furthermore, being on one of the EU’s blacklists raises the likelihood that you will appear on the other. This, and the fact that the EU also includes in its scoping criteria for “High Risk Third Countries” for money laundering and terrorist financing, “jurisdictions included in the amended list used by the OECD (2019)”, means that the EU is conflating tax compliance with AML/CFT compliance. Again, ‘non-compliance’ anywhere seems to equate to ‘non-compliance’ everywhere.

It is likely therefore that Vanuatu’s compliance with this deal could prove moot. Once the jurisdiction continues to be blacklisted by the EU, there is a very high probability that it will be listed as non-compliant with this deal. As such, this deal opens the door to further discrimination and provides yet another vector of vulnerability for Vanuatu.

We have seen this movie before. Since the beginning of time, the powerful have created structures to maintain and solidify their position, not weaken it. But everything has its limits. Institutionalised discrimination and systematic marginalisation of weaker states only radicalises and drives their leaders towards other pariahs and their most vulnerable towards you. For there is no ‘New World’ left for them to flee to, just the ‘First World’. Eventually, their problems become yours.

“Because when the rain falls, it don’t fall on one man’s housetop – remember that”

– Bob Marley and the Wailers, So Much Things To Say

Recognised as a top economist and advisor on the Caribbean, Marla Dukharan has led discussions and published reports on the Caribbean implications of COVID-19, the EU Blacklists, BREXIT, and changing US and Chinese policies, among other geopolitical developments. Marla has become a highly sought-after keynote speaker internationally on Caribbean issues, and she regularly advises governments, private sector executives and multilaterals to support their strategic decisions in the region.

- https://thecommonwealth.org/our-work/small-states ↩︎

- https://www.theguardian.com/world/2004/sep/16/iraq.iraq ↩︎

- https://marladukharan.com/wp-content/uploads/2021/05/EU-Blacklisting-of-Vanuatu-History-Analysis-and-Socio-Economic-Implications.pdf ↩︎

- https://www.aspistrategist.org.au/macrons-indo-pacific-vision-woe-betide-the-small-and-isolated/ ↩︎

- https://marladukharan.medium.com/jaccuse-the-european-union-s-institutionalized-racism-and-bullying-f4186d092f62 ↩︎

- https://www.taxjustice.net/wp-content/uploads/2020/04/Time-for-the-EU-to-close-its-own-tax-havens_April-2020_Tax-Justice-Network.pdf ↩︎

- https://www.oecd.org/about/document/ratification-oecd-convention.htm ↩︎

- https://taxjustice.net/press/tax-haven-ranking-shows-countries-setting-global-tax-rules-do-most-to-help-firms-bend-them/ ↩︎

- https://www.oecd-ilibrary.org/economics/taxation-and-economic-growth_241216205486 ↩︎

- https://www.reuters.com/business/reactions-landmark-global-corporate-tax-deal-2021-10-08/ ↩︎

- https://taxjustice.net/press/tax-haven-ranking-shows-countries-setting-global-tax-rules-do-most-to-help-firms-bend-them/ ↩︎

- https://www.nytimes.com/2021/10/08/business/oecd-global-minimum-tax.html ↩︎

- https://oecdecoscope.blog/2019/02/27/%EF%BB%BFfrance-inequality-and-the-social-elevator/ ↩︎

- https://www.lemonde.fr/blog/piketty/2017/04/18/inequality-in-france/ ↩︎

- https://voxeu.org/article/saving-paris-economically-efficient-and-equitable-rescue-plan ↩︎

- https://www.reuters.com/business/reactions-landmark-global-corporate-tax-deal-2021-10-08/ ↩︎

- https://www.wto.org/english/tratop_e/dispu_e/dispu_by_country_e.htm ↩︎

- https://www.reuters.com/business/reactions-landmark-global-corporate-tax-deal-2021-10-08/ ↩︎

- https://www.fatf-gafi.org/publications/financialinclusionandnpoissues/documents/unintended-consequences-project.html ↩︎

- https://www.reuters.com/article/global-tax-oecd-swiss-idAFL8N2R44EZ ↩︎

- https://taxjustice.net/press/oecd-tax-deal-fails-to-deliver/ ↩︎

- https://www.forbes.com/sites/taxnotes/2021/01/11/tax-policy-how-inclusive-is-the-oecds-inclusive-framework/?sh=17901b3565aa ↩︎

- https://www.rnz.co.nz/international/pacific-news/385606/vanuatu-pm-hits-out-at-france-over-matthew-and-hunter-dispute ↩︎

- https://www.europarl.europa.eu/doceo/document/E-9-2020-004220-ASW_EN.html ↩︎

- https://eur-lex.europa.eu/summary/glossary/proportionality.html ↩︎

- https://ec.europa.eu/info/sites/default/files/business_economy_euro/banking_and_finance/documents/200507-anti-money-laundering-terrorism-financing-action-plan-methodology_en.pdf ↩︎

- https://www.imf.org/external/np/ofca/ofca.aspx ↩︎