Read the original publication here

Vanuatu made the blacklist once again, this time for not having taxation policies in line with the European Union’s (EU) policies.

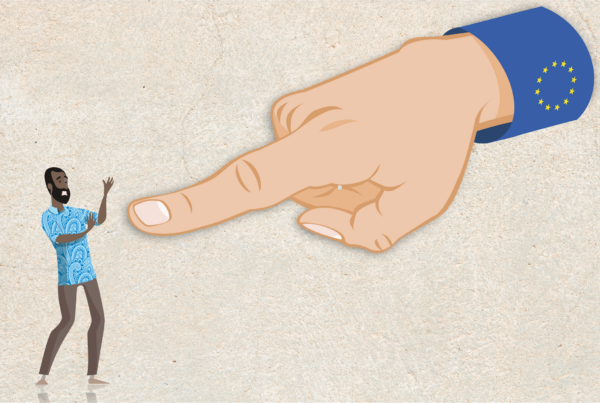

While Vanuatu is an independent nation and not a member of the EU, it is being picked on by the EU for being a tax haven like a few other nations on their blacklist.

According to Kasim Mohammed Nazeem, Press and Information Officer of the Delegation of the EU to the Pacific, based in Suva, Vanuatu is a non-EU tax haven.

Mr Nazeem explained there was a workshop in Fiji last year where the EU engaged with each Pacific nation on specific issues.

He continued to stress that countries on the list were given a chance to engage with the EU to address any particular issues that the EU had with them.

Refusal to engage with the EU resulted in the countries being blacklisted. Vanuatu was moved from the grey to the black list along with Aruba, Belize, Bermuda, Dominica, Fiji and Oman.

Nazeem was quoted saying, “jurisdictions need to comply with the principles of the EU code of conduct on business taxation, or the OECD’s forum for harmful tax practices.”

What is next for Vanuatu?

Willie Rex, Secretariat of the Vanuatu Competent Authority under the Ministry of Finance reckons that if no effort is done by the government to get us off the blacklist, we may face some consequences if the matter is not dealt with in a way that the EU wants.

Mr Rex also mentions that income tax is a possible way forward to get in the Eu’s good books despite Vanuatu having very tiny employed population.

The Secretariat also said the government are looking at other options to income tax however somewhere down the line the income tax may eventually have to be introduced.

Income tax as originally planned would deduct 17 % from a worker’s salary and employers would have to also pay cooperate tax, that in turn may cause employers to cut costs by laying off more workers.

When asked by 96 Buzz FM’s Coffee and Controversy team on whether it was worth introducing a tax that could have more people out of work just to impress the EU, Mr Rex said the Vanuatu Government is currently at a crossroad but he believes the government needs to work together with the EU in order to find other options as an immediate fix since Vanuatu not only came under the EU spotlight but also the OECD spotlight, therefore, drastic decisions must be made.

Should we really be worried?

From a private sector point of view, Damien Mullins, Senior Manager of AJC Vanuatu doesn’t believe we need to be worried as Vanuatu is a tax haven and being so, investors like that fact as there is less tax to pay.

What the EU is doing to Vanuatu is neo-colonialism and can easily be compared to typical school yard bullying where the bigger, stronger kids pick on the weak kids.

The EU want everything to be similar to them but forget that Vanuatu is a sovereign nation and has a right to have its own taxation system.

Before the EU criticizes Vanuatu, they should look within themselves and look at Republic of Ireland, Jersey, Isle of Man and Luxemburg which are all tax havens within the EU itself and 80 % of tax haven activities in the world take place within those nations.

What the EU basically want to do is to control and scare their own people from taking their money elsewhere and investing rather than staying at home.

Mr Mullins also made it clear that this action that the EU want to take on Vanuatu doesn’t include aid but if it did, it would not make a huge difference as most aid coming to Vanuatu comes from Australia, China, New Zealand and the World Bank.

What the EU gives to us is small compared to the other donor countries mentioned above.